Case Study: The Bridges Shopping Centre

Introduction The Bridges shopping centre, situated in the heart of Sunderland city centre, is the home

Find out more

Gary Butler, software specialist at Cellular Solutions, takes us through writing off incomplete orders in Sage 200cloud – and offers some handy guidance and advice.

There may be times where orders are over or under received, or times when something won’t be invoiced. In these cases, how would you deal with a Purchase Order that shows as Live when it needs to be showing as Complete?

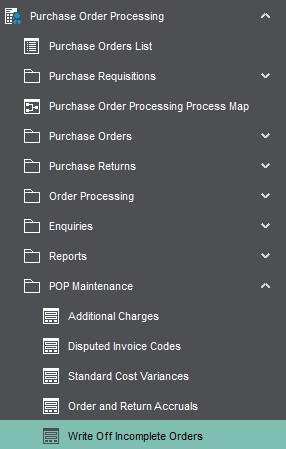

The Write off Incomplete Order option will handle this for you. It appears within Purchase Order Processing > POP Maintenance > Write Off Incomplete Orders.

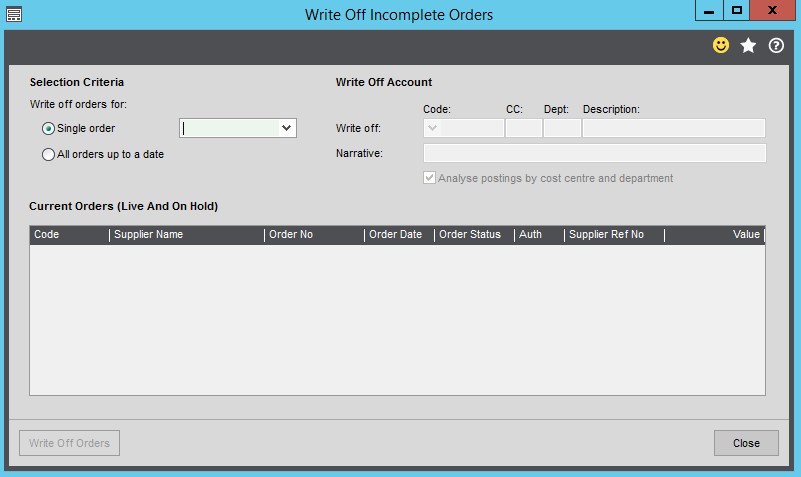

This option may sound and look daunting but will handle the Purchase Order and Stock/Nominal Postings correctly no matter what setting you have.

When you open the form, the first thing you’ll probably notice is it needs to set a Write off Nominal Code. It will depend on the scenario whether it posts to Nominal, but you will have to set a code. If you are not sure what code to set, check with your accountant as it could be different for each company, depending on your configuration.

Below are some examples of scenarios I’ve raised on demo data. If you are unsure on this process or any processes, you will either have a demo data set supplied by Sage or a test copy of your live data. I’d recommend trying things on non-live data if you’re ever unsure.

Below I’ve raised some Purchase Orders for Espresso machines….

Order Number 402 – 10 x Espressos

5 x Espressos received and invoiced

5 Outstanding

The 5 outstanding are never going to be received. Writing off these won’t post anything to the Nominal, because nothing is being written off that hasn’t been completed.

Order Number 401 – 10 x Espressos

10 x Espressos received

0 x Espressos invoiced

The items received will never be invoiced, so it will debit the Stock Nominal and credit the code entered on the Write Off form.

This is to show the value of stock has been raised (this can’t be done without the invoice). The code used in Write Off is to replace Creditors Control, because the money isn’t going to be paid as there isn’t money owed, as there is no invoice to be created. This kind of scenario is the least likely to occur, unless a company goes out of business or there is another situation where an invoice will never be received.

Order Number 410 – 10 x Espressos

0 x Espressos received

10 x Espressos invoiced

Within Sage 200cloud, you can invoice the goods and not receive them. If you are never going to receive the goods, when you write off, it will credit the Stock Nominal. This is because when you record the invoice it debits the Stock Nominal, as it’s expected the stock is there as you’ve been invoiced for it – and it would debit the code set in the Write Off screen.

Want more help in writing off incomplete orders in Sage 200cloud? Please contact Cellular Solutions to see how we could help.

Introduction The Bridges shopping centre, situated in the heart of Sunderland city centre, is the home

Find out more

Introduction Founded more than 30 years ago and situated in Carrbridge in the Scottish Highlands, Landmark

Find out more

Changing Lives is a national registered charity that provides specialist support services for 6000 vulnerable people

Find out more

Ensure your systems are working to their full potential and gain maximum benefit from your software.

Get the service, coverage and reliability you need to do business – and ensure your tariff is cost-effective.

Discover cost-effective alternatives to ISDN - ahead of its scheduled phase-out.