Case Study: The Bridges Shopping Centre

Introduction The Bridges shopping centre, situated in the heart of Sunderland city centre, is the home

Find out more

Sage 200cloud has released its Summer 2019 version. Along with the standard bug fixes, you can expect some sizzling new features!

In this Ask the Expert blog, our software specialist Gary Butler, takes a tour around new functionalities and improvements.

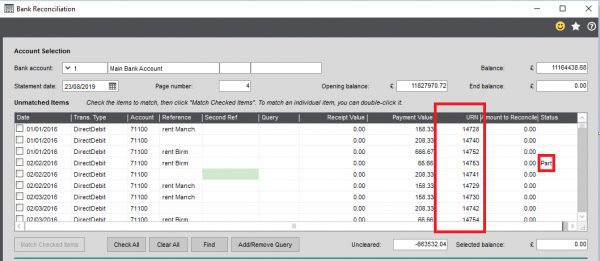

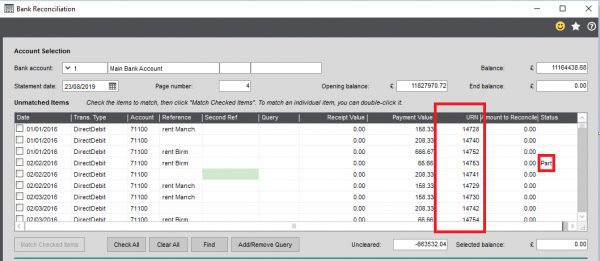

Bank Reconciliation Improvements

One improvement is something Sage took away from the reconciliation functionality previously – you are now able to part reconcile transactions again. Also, to help with the reconciliation process, Sage has added the URN to transactions, which might help with the cross-reference.

Reverse Charge VAT for CIS

As of October 2019, those working in the UK’s construction industry might have to handle and pay VAT in a different way following the introduction of the new VAT reverse charge system for the Construction Industry Scheme (CIS).

For supplies of certain specified construction services, the customer will be liable to account to HMRC for the VAT for these purchases instead of the supplier. The reverse charge will include goods, supplied with the specified services. Two new rate terms can be set up for Reverse charge CIS in the settings.

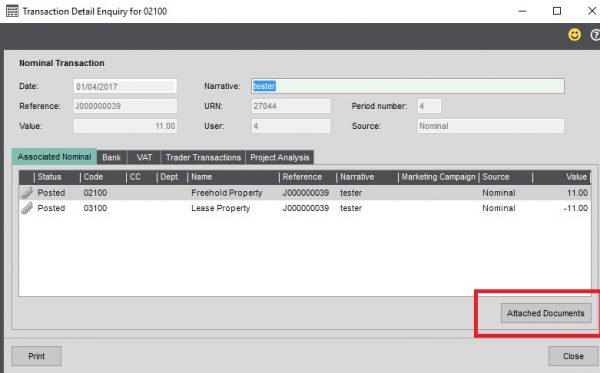

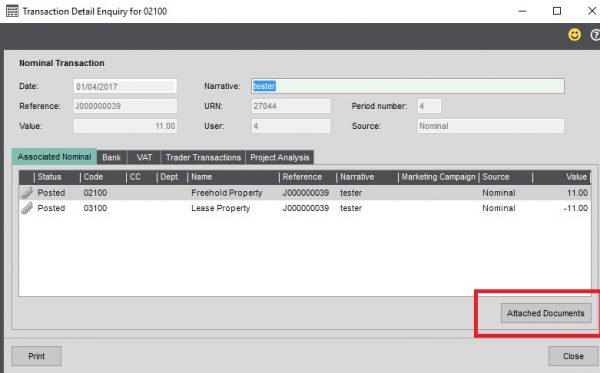

Document Attachments for Sales Invoices/Credit Notes, Goods Received, Nominal…

You can now attach files and scanned documents when you view sales invoices and credit notes, confirm receipt of goods (GRNs), and view the delivery history of a purchase order or return. Documents can also be viewed on the Nominal Postings when you do a Journal and attach a document.

Notional VAT improvements on Purchase and Sales Orders

A common bugbear for customers exporting outside the UK is when using VAT rates for EU countries, it can add notional VAT to the order. This is often confusing as this VAT will never be paid – Sage has changed how this is displayed in the program in accordance with how transactions are logged (as an invoice via Sales or Purchase Ledger or via SOP/POP.)

Brexit Preparations

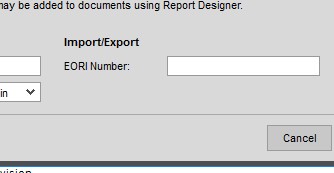

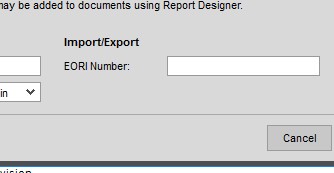

Ahead of the unknown outcomes for businesses after Brexit, Sage has added a couple of extra fields into the program as a best guess for its users. In the Company Details area, there is now an EORI field, which is required by UK companies trading in the EU, and Irish companies trading outside the EU.

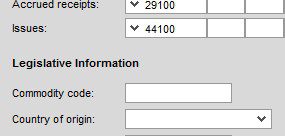

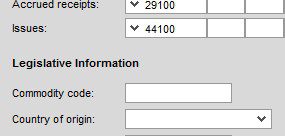

In addition, the country of origin field in now displayed on Stock items (which was originally only viewable if your program was set as an Irish company.)

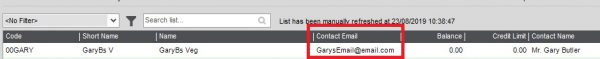

Default Contact Email on Customer and Supplier Lists

Based on customer feedback, Sage has added the Default Contacts email address as a column available on the list view.

Microsoft Flow improvements – Email Notifications for Purchase Requisitions and Supplier Bank Details

You can now send email notifications by using these new Microsoft flows. Microsoft Flow is a cloud-based service that makes it practical and simple for people to build workflows that automate business tasks and processes across applications and services. To use this feature, you’ll need to use Microsoft Flow with an Office 365 subscription.

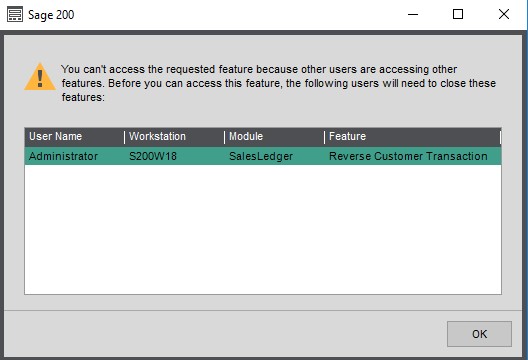

Displaying who is preventing access to a process

It can be frustrating when you want to run a year end and it says you can’t because someone is using a process but you don’t know who it is or which PC is being used. Sage 200cloud now allows you to view that information and keep track of who is locking a process on a handy popup. Therefore, you can easily check if there’s a disconnected login or if not, speak to the colleague and ask them to come out.

If you’d like to know more about Sage, check out the rest of our Ask the Expert guides, or get in touch with us here. If you’ve got a burning question for one of our Experts, feel free to tweet us at @CellSolNE or give us a call on 08700 118 000.

Introduction The Bridges shopping centre, situated in the heart of Sunderland city centre, is the home

Find out more

Introduction Founded more than 30 years ago and situated in Carrbridge in the Scottish Highlands, Landmark

Find out more

Changing Lives is a national registered charity that provides specialist support services for 6000 vulnerable people

Find out more

Discover cost-effective alternatives to ISDN - ahead of its scheduled phase-out.

Streamline your business and enable better collaboration… with cloud solutions.

Enable your mobile workforce to operate more efficiently and communicate more effectively, with smarter technology.